Navigating Inflation:

A Guide to Ensuring a Financially Secured Retirement

In today's economic climate, individuals across the globe are grappling with the escalating cost of living. Inflation, often dismissed as a mere buzzword by those outside the economic sector, significantly influences our daily lives and financial security. This comprehensive guide aims to shed light on the nuances of inflation, its impact on savings, and practical strategies to secure a financially stable retirement amidst rising costs.

Understanding Compounded Inflation

Compounded inflation incrementally affects our financial well-being, particularly over the long haul. A critical aspect often overlooked is the widening gap between the inflation rates of necessities (such as food and transportation) and the relatively meager interest rates offered on savings. This discrepancy erodes purchasing power over time, rendering what a dollar buys today more expensive in the future. For example, the annual inflation rates for food and transport have recently been reported at 4% and 8%, respectively, while savings interest rates linger around 3%. This imbalance underscores the challenge of preserving, let alone enhancing, the value of our savings.

The Rising Cost of Living: A Real-world Illustration

Consider the cost of a simple cup of coffee: from $0.40 in the 1990s to $1.40 today, with projections suggesting a rise to $1.81 in the next decade. This example vividly illustrates the relentless march of inflation and its tangible impact on everyday expenses.

Bridging the Gap: The Necessity of Additional Income Streams

The disparity between inflation rates and savings growth starkly highlights the inadequacy of relying solely on savings for retirement. Cultivating additional income streams becomes not just advantageous but essential for ensuring a financially secure retirement. Passive income, in contrast to active work or trading income, is key to achieving this goal.

Exploring Passive Income Strategies

Several strategies can facilitate the creation of passive income:

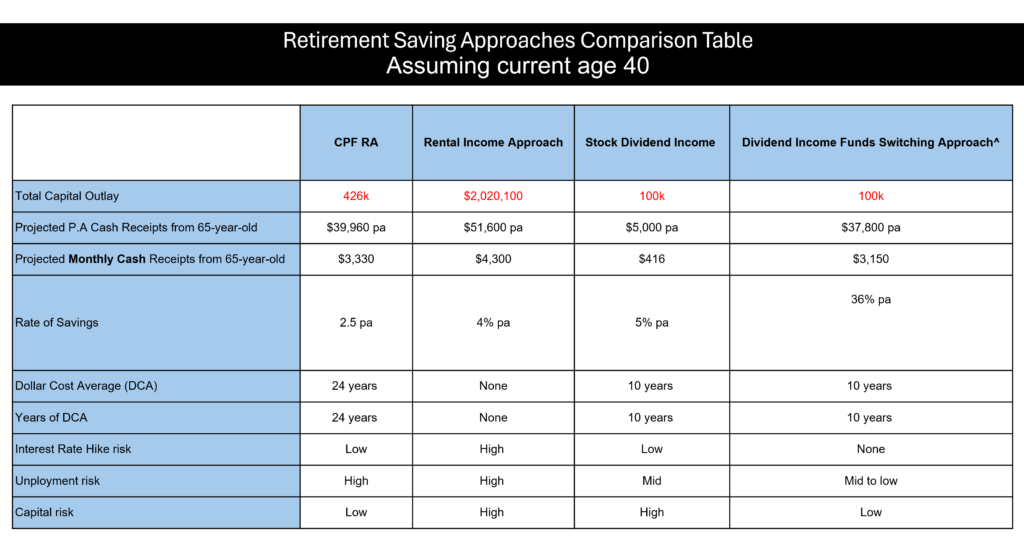

1. CPF Retirement Account: Leveraging Singapore's CPF Retirement Account can be a viable strategy, offering projected monthly incomes based on accumulated savings by age 65.

2. Property Rental Income: Investing in real estate, such as a 2-bedroom condo in Clementi, poses both opportunities and risks, given fluctuating rental markets and potential global economic challenges.

3. Dividend Investing: Stocks, particularly blue-chips offering dividends, present another avenue for generating passive income, albeit with associated market, industry, and company risks.

The Path to Golden Retirement: A Holistic View

Addressing the potential pitfalls in each strategy is crucial. From global interest rate hikes affecting mortgage repayments to the unpredictable nature of stock dividends in relation to inflation, a comprehensive approach is necessary. Combining strategies to leverage their strengths while mitigating risks through diversification and contingency planning is key to ensuring a robust retirement savings plan.

Conclusion: Crafting Your Customized Retirement Strategy

Embracing a combination of strategies, each carefully selected to match the certainty of inflation with the compounding effect of savings, is the secret to securing a comfortable retirement. This approach not only increases the certainty of your retirement savings but also provides a safeguard against the unforeseeable risks associated with high leverage investments.

Take the Next Step

Ready to explore a bespoke strategy that ensures your retirement savings thrive in the face of inflation? Book your discovery session today to assess your eligibility for a customized plan designed to safeguard your golden years.

Let's embark on this journey together, fortifying your financial future against the ever-present challenge of inflation.

Join our telegram channel Mirormi Finance to be updated with latest AI optimising cash flows techniques.

We welcome enquiries to participate, leverage and grow collectively.

Email us at richie@mirormi.com